FAQ – frequently asked questions

Here you can find the answers to frequently asked questions.

General information.

What can ALPHERA Financial Services offer me?

What happens if I have an accident or fall ill?

What happens if I can no longer pay my instalments?

Can I drive my leased vehicle abroad?

Can I end a contract early?

INSURANCE.

What kind of vehicle insurance do I need to take out?

FINANCING.

What are the benefits of financing with ALPHERA Financial Services?

How are the monthly repayments calculated?

Do I need to make a down payment?

What is the difference between leasing and financing?

What is leasing?

How long is a lease agreement?

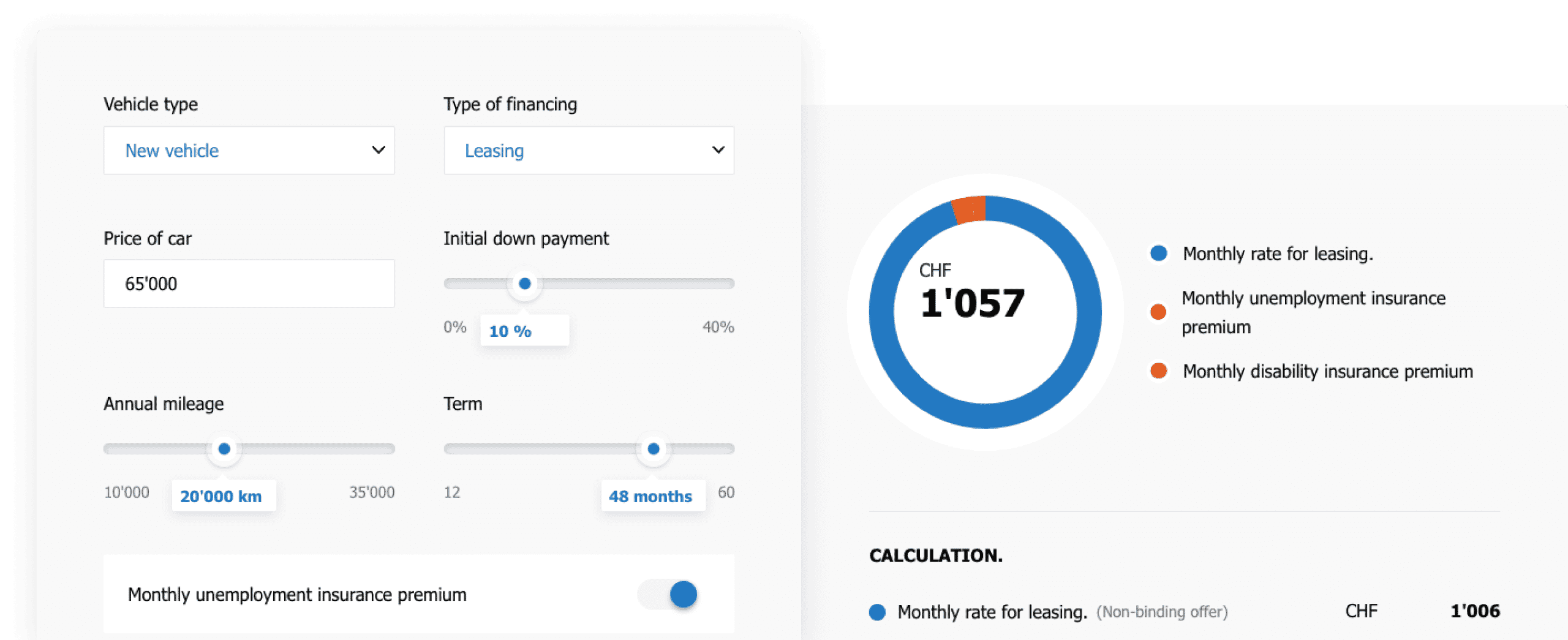

How is the leasing rate calculated?

What happens if the vehicle is written off or stolen?

Your dream, our financing.

When it comes to vehicle financing, each customer has different needs. We adapt the parameters in line with your requirements.

Calculate financing costs now